euro croatia

No More Obligation for Croatian Kuna on the Shelves

December 13, 2023 – With the last day of 2023, the Croatian kuna might disappear from shops, cafes, businesses, you ...

Croatian ATMs Finally to Start Giving Out 50 and 100 Euro Notes

After a few months since the introduction of the euro in Croatia, new banknotes will be available at Croatian ATMs ...

European Central Bank: Intro of Euro in Croatia Only Mildly Affected Prices

As Index writes, the analysis was published in a blog post titled Has the Euro Changeover Caused Extra Inflation in ...

CNB: Introduction of Euro has not Worsened Inflation in Croatia

“Movements in January suggest that the introduction of the euro in Croatia could have had a relatively mild impact on ...

Lidl Croatia Explain Why the Same Products are Cheaper in Slovenia

Index compared Lidl prices in Slovenia and Croatia in detail. “In the case of comparing prices in Slovenian and Croatian ...

Euro Croatia Price Increase: Politician Kreso Beljak Shopping Across Border

As Poslovni Dnevnik writes, while appearing as a recent guest of N1 studio, the President of the Croatian Peasant Party, ...

Euro Croatia: Reasons Why Same Products are Cheaper in Slovenia

Slobodan Školnik, an expert on retail prices, comments on the reasons why: “Because our weak economy has to bear the ...

Euro Croatia: Initial Phase of Transition is Progressing Well, States EC

As 24Sata writes, they report that the majority of cash payments (51%) in euros in stores were made on January ...

Euro Croatia: The Saga Continues, Government Tackling Price Increases

“We warned there would be a negligible price increase; it was like that elsewhere. But what we are witnessing is ...

Euro Croatia is Here, and You Guessed It – Much More Expensive

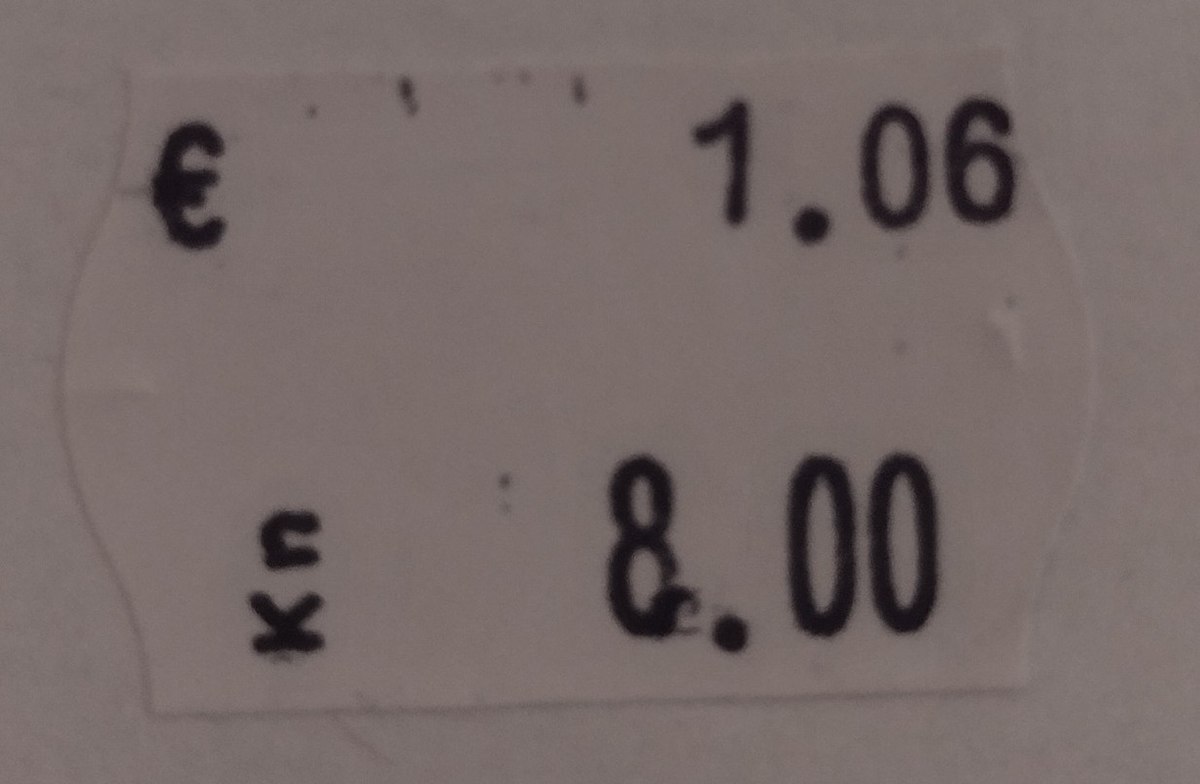

As Index writes, what most of the complaints have in common is the rounding up. So, for example, if something ...